Initial worker compensation benefits are based on an estimate of policyholder's payroll and they need to actualize payroll to charge the right amount. For this, workers' compensation audits can be stressful and business owners may end up owing money. For instance, the worker compensation audit issue after expired. A workers' compensation audit might help you to minimize your stress, though we can't provide you a comprehensive list of the rules for every carrier. We can give you a general idea about what to expect.

1. Schedule Your Workers’ Comp Audit

The first step you should be followed is, preparing a worker compensation audit. Generally, your insurer notifies you that it's time to prepare an audit about six to eight months prior to your policy's expiration date. There are types of audit that are varied by insurer and state, but there are generally two main types:

- Physical audit: When your insurer sends an auditor to your business to review records, observe operations, and interview employees. The auditor has about 30 days to planing to submitting your paperwork.

- Voluntary audit: No need to comes anyone to your office to do an audit. This audit is conducted by e-mail, phone, or mobile. Your insurer sends you a form. You need to fill it out and return within a certain period.

If you’re required to have a physical audit, schedule it so you’re available to answer any questions that the auditor might have. That way, you can make sure the auditor understands your operations so that they can classify your business accurately.

Other Types of Workers’ Comp Audits

Not all workers’ compensation audits occur when policies are set to expire. Depending on their situation, some business owners may have a:

- Preliminary audit: Your insurer may conduct an on-site preliminary audit when you first apply for workers’ compensation insurance to determine your initial premium. This may be trickier to schedule if you need to get covered quickly to be in compliance.

- Interim audits: Insurers may require an audit during the life of your workers’ comp policy, particularly if you’ve changed operations. Additionally, employers might ask for interim audits if they want to pay their workers’ comp every quarter. Interim audits are usually done by mail.

For both types of audits, you should still receive some sort of notification from your insurer so that you can set time aside for the audit.

2. Gather Your Records

Workers’ compensation costs are based on your payroll, risk, and claims history, so the auditor needs information about each of these aspects. Typically, audit notifications spell out the documents the auditor can use to verify the information. This list can be specific to the carrier, but many insurers want some or all of the documents mentioned below.

General Information

- Description of company operations

- Job descriptions for each employee

- Number of employees at each location

- Owners/officers names and titles

- Description of work performed by contractors and subcontractors

Payroll Records

- Accounting ledger

- Payroll journal or register

- Business checkbook

- Federal Profit and Loss From Business Schedule C (Form 1040)*

- Federal Employer’s Quarterly Tax Return (Form 941)

- Federal Employer’s Annual Tax Return (Form 944)

- Federal Employer’s Annual Unemployment (FUTA) Tax Return (Form 940)

- Federal 1099, W-2, and W-3 transmittals

- State unemployment insurance tax reports (forms vary by state)

- Time cards or number of hours, days, and weeks worked annually

- Overtime payroll records

*For individuals and sole proprietors

Cash Disbursements Records

- Payments made to subcontractors

- Payments made to independent contractors

- Payments made to casual laborers

- Receipts for materials purchased

Insurance Records

- Subcontractors’ certificates of insurance

- Business’ experience modification worksheet

What Is Included in Payroll

Your payroll, also referred to as remuneration, is the starting point for your workers’ comp premium, so you want to get that number right when preparing for an audit. However, it’s not always clear what counts as payroll. Each state has its own definition, but, in general, remuneration includes:

Gross wages and salaries

- Total commissions

- Bonuses

- Pay for overtime, holiday, vacation, and sick days

- Employee contributions to 401(k)s, savings plans, and individual retirement accounts (IRAs)

- Payments based on something other than time worked

- Payments you make that would otherwise be the responsibility of the employee like Social Security

- Payments or allowances for hand tools or power tools employees use for work

- Lodging and meals included as part of an employee’s pay

What Is Excluded From Payroll

Conversely, employee paychecks may include payments that aren’t usually counted as payroll in workers’ comp premium calculations. For example, many states exclude:

- Tips and gratuities

- Employer payments to group insurance

- Severance pay

- Reimbursed business expenses

- Special rewards for individual invention or discovery

- Active military duty pay

- Uniform allowances

- Employee discounts on goods and services

- Make sure to identify these to the auditor, so they are not inadvertently included in your total payroll.

Are All Salaries Included in a Workers’ Comp Audit?

In general, business owners do not have to carry workers’ compensation insurance for themselves, so their salaries aren’t considered during a workers’ comp audit. However, some states give sole proprietors, corporate officers, partners, and limited liability company (LLC) members the option of getting coverage. When they do, their salaries are treated differently because their pay is often significantly more than regular employees.

Most states set an annual wage for sole proprietors and partners that is different from their regular salaries. Somewhat similarly, corporate officers who opt-in on workers’ comp receive a weekly salary that falls somewhere between a maximum and minimum salary determined by the state. LLC members get one or the other, depending on the state’s workers’ compensation rules.

3. Update Your Job Descriptions

The risk your employees face in their jobs is another part of calculating your workers’ comp costs so that the auditor will investigate everyone’s duties and your business’s general operations. This may involve reviewing job descriptions you already have, or it could mean completing a form that lists what each employee does. Either way, you should have a strong understanding of what the people who work for you do. A good way to accomplish that is to update your job descriptions—or create them if you haven’t already.

Why Job Descriptions Matter in a Workers’ Comp Audit

You might be tempted to skip this step, however elaborate job descriptions may be an enormous facilitate during a workers’ comp audit. correct job descriptions facilitate your auditor confirm the acceptable governing category code for your business. That category code features a corresponding interest rate that's employed in a formula to work out your prices. exploitation the incorrect category code may mean you’re paying the incorrect premium.

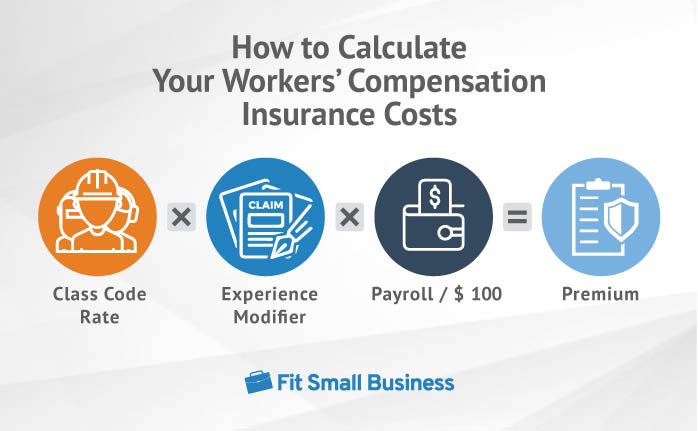

The basic formula for calculating workers’ compensation insurance costs factors in three numbers: the rate assigned to your class code, your experience modification rate, and your payroll divided by $100.

Let’s say, as an example, you run a craft brew distillery in Wisconsin with a payroll of $100,000. The auditor assigns your business the category code 2121, which implies your rate of interest is $3.11. to stay things easy, let’s additionally assume your expertise modifier is one, therefore it doesn’t impact your rate which there are not any different fees or discounts. If all of that's true, then your workers’ comp prices $3,110 per year:

Breweries - Craft Beer ($3.11 x $100,000 / $100)

However, your auditor could miscalculate your premium if you forget to say that you just even have a clerical worker (class code 8810) United Nations agency earns $40,000 per annum. Clerical staff square measure Associate in Nursing example of normal exception categories. These categories aren’t enclosed within the governing category code and find rated individually. the bottom rate for your clerical employee is twenty cents, therefore the worker solely prices $80 to insure every year:

Clerical - Office Employee ($0.20 x $40,000 / $100)

$80.00

Ultimately, your workers’ comp bill should look like this:

Clerical - Office Employee ($0.20 x $40,000 / $100)

$80.00

Breweries - Craft Beers ($3.11 x $60,000 / $100 )

$1,866.00

Base workers’ comp premium

$1,946.00

When you rate the workplace worker otherwise than the remainder of the employees, your overall insurance prices go down. Having this info available throughout your audit helps the auditor assess your premium accurately.

4. Review the Auditor’s Work

Once your audit is complete, review the auditor’s work to create positive his info matches your understanding of your business’s payroll and operations. Essential info to review includes:

- Payroll data: Check that your audited payroll matches the payroll from your accountant or accounting department.

- Governing Classification: Unless your operations have more matured a vast overhaul, your governing classification ought to match the one on your original workers’ comp policy.

- Any further classifications: If your state permits them, check whether or not normal exception categories are noted. constant goes for construction businesses that get to use multiple category codes for individual employees.

- Experience modifier: Most states interdict insurers from dynamic your expertise modification rate throughout the policy term. If the auditor changes yours, you ought to raise why.

Once you review the auditor’s work, sign any work the auditor needs to point you’ve taken half, and perceive the results. This step might not be obtainable to you if you completed the audit remotely, however, your underwriter ought to send you an outline of the auditor’s findings. If those results appear out of whack, you'll request additional data from your underwriter.

How to Dispute a Workers’ Comp Audit

If you don’t have to be compelled to pay any extra perhaps even received a refund―you will relax till next year’s audit. However, your underwriter may decide you paid deficiently and send you a bill. therein case, you either got to write a check or dispute the audit.

Each carrier has its own rules for disputing a workers’ compensation audit. However, most insurers expect employers to file a dispute in writing at intervals a group time, thus you ought to contact your carrier instantly. possibly, your carrier can need details on why you think that your bill is wrong associated with an estimate of what you think that it ought to be. You won’t need to pay the extra premium whereas your insurance underwriter evaluates your grievance, however, you will be needed to pay any undisputed portion by the date on the audit bill.

Common Mistakes in Workers’ Compensation Audits

Being charged an additional premium doesn’t automatically mean the auditor made a mistake. Workers’ compensation premiums are complicated things, so mistakes are pretty common. Below are a few of the most common errors:

- Including items in payroll that shouldn’t be there

- Using the wrong class codes for employees

- Changing your experience modifier

- Charging for an insured subcontractor

- Including exempt workers in the payroll

How to Make a Workers’ Comp Audit Easier

Every company that problems workers’ compensation insurance reviews policies at the top of their terms, thus you can’t avoid Associate in Nursing audit. However, you'll create the audit method easier if you choose pay-as-you-go workers’ compensation.

Pay-as-you-go Workers’ comp could be a payment set up wherever your nondepository financial institution charges you whenever you run payroll. This typically needs you to transfer or enter your payroll info to the insurer’s platform manually. However, some payroll firms will integrate together with your nondepository financial institution to transfer your information and pay your premium mechanically.

The big point here is that a pay-as-you-go set up means that your workers’ compensation premium is a lot of correct. Your nondepository financial institution still must audit your policy as a result of there might be errors in classifications or remuneration however pay-as-you-go plans typically lead to smaller premium changes.

Workers Comp Audit Penalties is essential for non-emergency medical transport (NEMT) businesses. It safeguards employees and ensures compliance with legal requirements. However, failure to adhere to workers comp audit procedures can result in severe penalties. These penalties not only affect your financial stability but also damage your reputation. This article explores the intricacies of workers comp audits, the penalties for non-compliance, and how NEMT operators can mitigate risks effectively.

ReplyDelete