To estimate the costing for an employee, divide payroll by 100, then multiply that number by your workers’ compensation insurance rate:

(Annual Employee Payroll / 100) x Workers’ Compensation Insurance Rate = Estimated Workers’ Compensation Cost

Read on for step-by-step instructions, and other factors that play a task in your final workers’ compensation quote.

How Is Workers’ Comp Insurance Calculated?

Workers’ compensation insurance costs are calculated supported what your business does (classification code), your total payroll and other factors the insurance carrier might use to assess your business risk (history of workers’ compensation claims, for example). And because workers’ compensation is regulated at the state level, workers’ compensation rates differ supported the state where employees work.

While policies are nearly always active for 12 months, a workers’ compensation insurance quote might be represented as an annual premium or the monthly payment. Your preferred payment plan and any changes in your payroll throughout the year will also influence your final cost.

1. Add Up Payroll for Each Employee

A workers’ compensation policy is predicated on payroll, no matter whether the worker is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee.

Tips for Calculating Payroll:

- Gross payroll for every employee is often rounded to the closest $1,000.

- If you’re unable to calculate the exact payroll for the year (for example, if a worker is paid hourly), estimate projected payroll. Your final work comp premium is often adjusted up or down at the top of the policy year to account for over- or under-estimating payroll.

Note: If hiring any independent contractors, check your state regulations for whether you'll be held responsible for their workers’ compensation coverage.

2. Find Your Classification Code(s)

Your classification code is one of the foremost important details to urge right if you would like an accurate workers’ compensation quote.

Class codes are four-digit numbers that are assigned to businesses based on industry. By grouping together similar businesses, data can be collected on workplace injuries and workers’ compensation claims. This data is then employed by the rating agency to assess the relative risk related to that sort of work, and assign a rate supported recent losses (claims that have been filed and paid out).

To determine your classification code, consider:

- What is the first product or service you sell? Carpentry, commercial cleaning, HVAC repair, etc.

- What other tasks do your employees perform? Common roles include sales, clerical or delivery.

- Do you have any contractors or sub-contractors that require coverage? If yes, what do they do?

WorkCompOne’s online quoting tool makes it easy: Search keywords to find your classification code — or enter the four-digit number if you know it.

3. Look Up Your Workers' Compensation Rate

While many classification codes are standardized across us, workers' compensation cost is predicated on the speed set by your state’s rating agency or bureau. Check with your state’s workers’ compensation regulatory body to seek out out which agency sets workers’ compensation rates. Many U.S. states use the National Council on Compensation Insurance (NCCI), while others use their own state rating bureau.

From there, you'll be ready to search or contact the rating bureau to urge the speed for your classification code.

A workers’ compensation rate is represented because of the cost per $100 in payroll. For example:

- A rate of $1.68 means that a business with $100,000 in payroll would pay $1,680 annually in work comp premiums.

- A rate of $0.35 means that a business with $100,000 in payroll would pay $350 annually in work comp premiums.

This will offer you an estimate; not a particular quote. In most states, insurance companies are allowed to deviate from the “advised rates” published by the state’s rating agency. In some cases, the advised rate may differ greatly from the one an insurance firm offers you.

For the foremost accurate rate and best price, request a quote from several insurance carriers. Or, use an agency, which may go searching and present you with the foremost competitive quote.

How Are Workers’ Comp Rates Determined?

The state rating bureau sets the speed or baseline cost of workers’ compensation insurance by collecting and analyzing loss data—workers’ compensation claims data. This data can show patterns, like changes in:

- The number of or types of claims being filed.

- The cost per claim paid out.

- Total healthcare costs for workers’ comp claims.

- Days of work (payroll) missed by injured workers.

While rates are specific to every class code, statewide rates are often raised and lowered at an equivalent time and as a percentage. These rate adjustments are made to reflect changes in the performance of the state’s workers’ compensation system as a whole; for instance, lower healthcare costs or fewer claims as a result of improved workplace safety.

To learn more about workers’ compensation insurance rates, read “Workers’ Compensation Insurance Rates: What they're & How They’re Set.”

3. Calculate Estimated Workers’ Compensation Cost Per Employee

To find an estimate of the cost per employee, multiply the speed by the worker payroll.

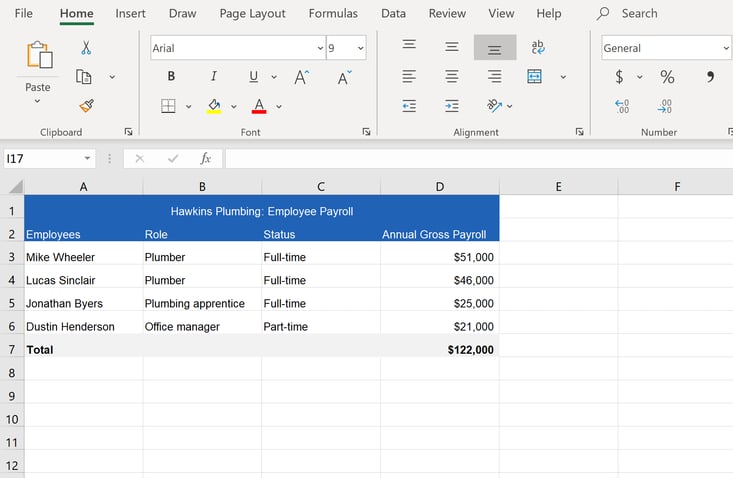

For example, This Hawkins, Indiana plumbing business has two plumbers employed, who make approximately $50,000 per annum. It also has one plumbing apprentice who makes $25,000 per annum, and one part-time office manager, who handles clerical tasks and is paid $21,000 per annum. The owner enters these details into a spreadsheet to calculate the value per employee. When added up, Hawkins Plumbing has a total payroll of $122,000 annually:

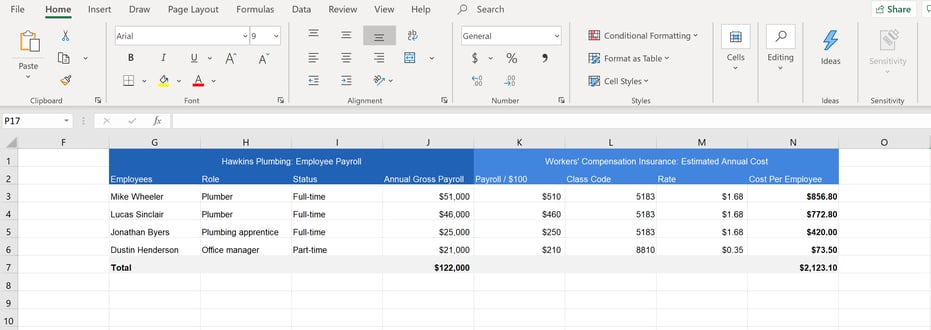

Rates are expressed per $100 in payroll, so he divides the plumbers’ payroll and clerical payroll by $100, then multiplies that number by the speed for every class code. The workers’ comp rate for plumbers (NCCI code: 5183) is $1.68, and therefore the rate for clerical or office workers (NCCI code: 8810) is $0.35.

Also, note that Dustin Henderson’s part-time employment does not impact his coverage. His full annual payroll must be included, and coverage for all employees must be in effect for the whole year.

Based on these 2018 rates in Indiana, Hawkins Plumbing could expect to pay approximately $2,123 in annual workers’ compensation cost — or, but $200 per month.

If operating during an interest rate state, this total amount is your workers’ compensation premium, before credits and debits are applied (more thereon below). Base rate states require all insurers to use the workers’ compensation rates set by the state rating agency.

For those not in interest rate states, the premium could vary supported the insurer you select. Insurance carriers must submit their rates to the state’s regulatory body for approval, but rates may vary supported their individual history of losses. Shop around for several quotes to match, and confine mind other factors like reputation and customer service before making a final judgment.

Your True Workers’ Compensation Cost

Your payroll and rate will offer you an honest estimate of workers’ compensation costs, but your final premium may look a touch different. Why?

A workers’ compensation rate assigns a tag to businesses within an equivalent industry, but workplace safety and workers’ compensation claims can vary widely from one company to subsequent.

The insurance company may take other factors into consideration when calculating a quote, so it better reflects the characteristics of your business.

Common factors include:

- Loss history or past workers’ compensation claims filed.

- Premium discount factor for companies with larger premiums (usually above $10,000 per year).

- Experience Modifier, which is assigned to larger companies after several years in business, for either poor or excellent claims history.

- Premium credits for such things as a proper safety program, safety officer on staff, or other measures of your company’s commitment to a secure workplace.

The insurer may apply credits or debits to the premium to work out the ultimate quote you’re offered. To save money on your workers’ compensation policy, ask an insurance broker for advice and programs or pieces of training that will qualify your business for savings.

Hire a worker compensation audit lawyer to estimate the costing.